A payroll It is a document that a worker receives, usually every month, from the company and which reflects the different monetary amounts that make up the worker's salary. Therefore, this document serves as a certificate that the company has paid the corresponding amounts for the employee.

But the payroll is not only made up of the amount that the employee receives in his bank account, but it is made up of different parts, all of them important and that as Human Resources experts we must be able to understand and know how to calculate.

So that you perfectly understand each point of a payroll, we are going to see below the different parts of which a payroll is made up.

1. Top

At the top of the payroll we find The first thing we find in the payroll is the data of both parties, that is, on the one hand, the company data and, on the other hand, the worker's data.

The company data that appears is the name of the company, address, CIF and social security contribution code.

The worker's data is the full name, tax identification number, Social Security affiliation number, professional category, contribution base group and seniority in the company.

The category and professional group will depend on the collective agreement to which the company adheres.

2. Settlement period

The next information that appears on the payroll is the time interval for which the worker is paid, including the day, month and year, and the total number of days.

As we mentioned at the beginning of this article, payrolls are made up of different amounts that we must understand correctly to configure it. Within these, we are going to see the most important quantities.

3. Gross amount and net amount

What do these terms mean? Is there a difference between them? Yeah! And they will be reflected in our payroll as Total Earned, gross amount, and Total Liquid to be received, net amount.

Gross amount is the total monetary amount before necessary deductions and withholdings are applied.

All amounts that are part of the payroll contribution base are reflected in the Earnings section, which includes the base salary per day, hours and overtime pay, bonuses, salaries in kind and salary supplements.

Net amount It is the final amount that the worker receives after deducting the deductions and withholdings made by the company, that is, the money that the worker receives in his or her account.

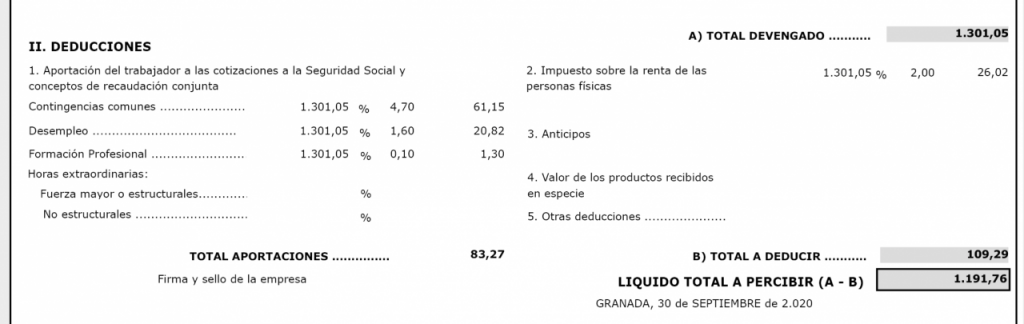

4. Withholdings and deductions

The personal income tax withholdings They make up the money that workers advance to the Treasury in anticipation of what they will later have to pay in the income tax return. The obligation to pay this withholding is the responsibility of the company.

5. Liquid to be collected

He liquid to perceive It is the so-called “net salary”, and it is what the worker has in his checking account. This count is calculated by simple subtraction:

Total liquid when received = Total accrued – Total deductions

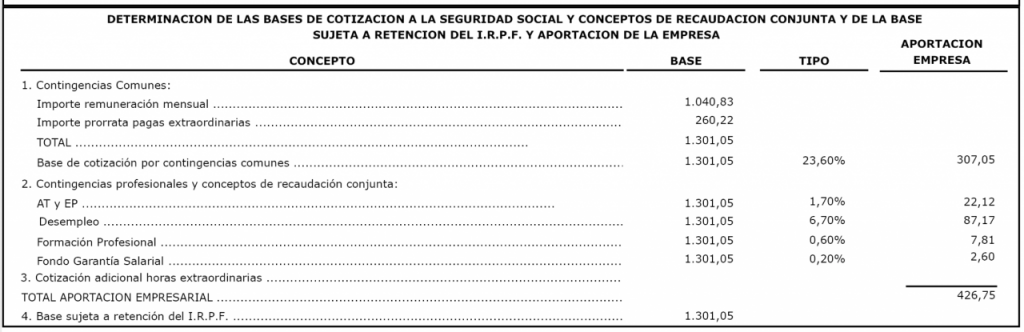

6. Basis of contribution

We reach the final part of the payroll, in which we will find the payroll contribution bases. These are used to calculate the benefits that correspond to the worker to Social Security and that take into account the different amounts that the company must contribute.

Do you want to know how Human Resources professionals create payrolls?

In it master's degree in Human Resources Management At the EIP International Business School we prepare our students to become the professionals that companies are looking for. In this way, our teaching includes learning how to use the most used software in companies for payroll and equipment management.

Do not hesitate to consult our Curriculum and contact our team to resolve any of your questions.