What does the VAT rate reduction consist of?

The ukrainian war has triggered numerous alterations in the world economic order and especially in Europe. The inflation is affecting all sectors and energy crisis, in which we find ourselves immersed, is one of the main points of increase in the daily life of companies and families.

To curb the impact of this increase in energy service prices, the central government has established temporary measures so that the economic impact is less. One of these measures consists of the reduction of the VAT rate to 5% in energy (electricity and gas) for certain activities or rather, for certain types of business or family situations.

In this article we see in detail who, natural or legal person, will be affected by this tax rate reduction and how to adjust the new one VAT rate inside of the SAGE 50 business management software.

- Royal Decree-Law 11/2022, of June 25, by which certain measures are adopted and extended to respond to the ceconomic and social consequences of the war in Ukraine, to address situations of social and economic vulnerability, and to the economic and social recovery of the island of La Palma set in your Art.18 the applicable tax rate of Value Added Tax to certain intra-community deliveries, imports and acquisitions of electric power.

Application of 5% tax

Thus, “with effect from July 1, 2022 and valid until December 31, 2022, The 5 percent rate of Value Added Tax will be applied to deliveries, imports and intra-community acquisitions of electrical energy carried out in favor of:

a) Holders of electricity supply contracts, whose contracted power (fixed power term) is less than or equal to 10 kW, regardless of the level of supply tension and the contracting method, when the arithmetic average price of the daily market corresponding to the last calendar month prior to the last day of the billing period has exceeded €45/MWh.

b) Holders of electricity supply contracts that are recipients of the social electricity bonus and have been recognized as severely vulnerable or severely vulnerable at risk of social exclusion, in accordance with the established in Royal Decree 897/2017, of October 6, which regulates the figure of the vulnerable consumer, the social bonus and other protection measures for domestic consumers of electrical energy.”

Reduction of the VAT rate to 5% in energy

The power contracted in a location will depend on multiple factors. such as the activity that is carried out, the M2 of the premises, volume of activity... since, ultimately, they will determine the specific needs for electrical power, therefore, it would be a matter to be calculated in each specific case.

However, to serve as a reference, the power that a bar or cafeteria will generally need already ranges between 10 and 15KW, in the case of restaurants it is normal for them to exceed 15KW, the fact that, in the In cases of contracted power from 15KW, power control will be carried out through a maximeter. This measuring instrument, unlike the ICP, does not cause supply cuts in the event that the contracted power is exceeded. It will be mainly small commercial premises that will mainly benefit from this measure.

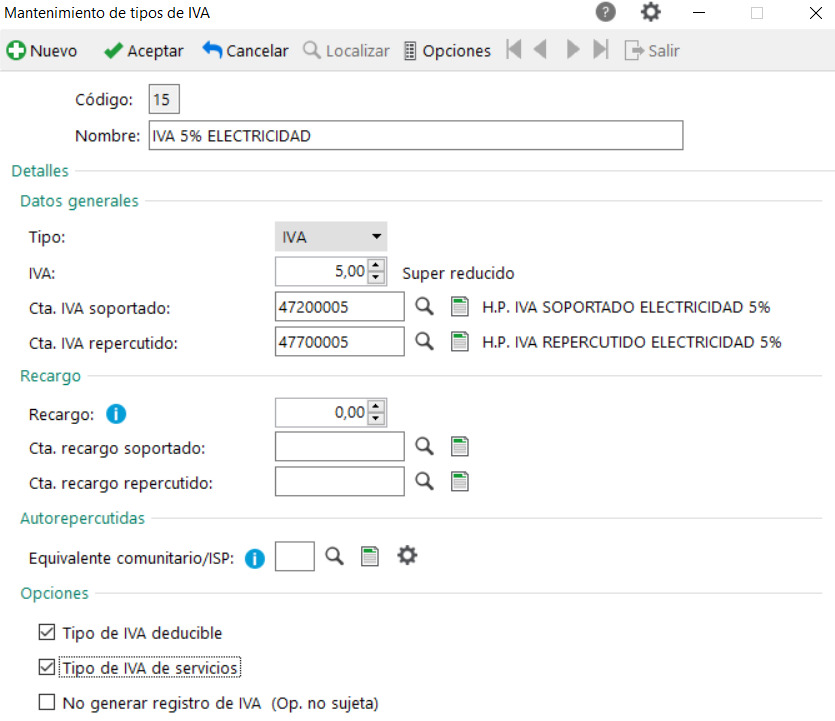

Creation of VAT to 5% in Sage

The first thing we will have to create a new VAT type code in Sage50, for this from accounting module through the route Files>VAT rates.

Later we must configure the 303/390 models From the business maintenance screen, locate the Accounting>Models – VAT/IRPF>Form 303/390/SII tabs. Where we will include the new VAT type code:

General VAT settlement instructions

For periods 07 to 12, Q3 and Q4:

In boxes 01, 02 and 03, the tax bases taxed at the rates of the 4% and 5% and the resulting fees. In the case of operations at the type of 4% and 5% simultaneously, the sum of the BI corresponding to both types will be included in box 01, in box 03 the sum of the quotas corresponding to the two types and in box 02 the will indicate the type to which a higher quota corresponds.

Also, the Royal Decree-Law 17/2022, of September 20, which adopts urgent measures in the field of energy, in the application of the remuneration regime to cogeneration facilities and temporarily reduces the rate of Value Added Tax applicable to intra-community deliveries, imports and acquisitions of certain fuels In its CHAPTER III it establishes a series of urgent measures to reduce the applicable rate of Value Added Tax to intra-community deliveries, imports and acquisitions of certain fuels:

Article 5. Value Added Tax rate temporarily applicable to intra-Community deliveries, imports and acquisitions of natural gas.

With effect from October 1, 2022 and valid until December 31, 2022, the rate of the 5 percent of Value Added Tax to deliveries, imports and intra-community acquisitions of natural gas.

If you are interested you can find information about our Master in Financial Management, Accounting and Management Control or the Master in Financial Management and Functional Consulting SAP S/4HANA Finance.