The Prospect Theory is a theory developed by psychologists Daniel Kahneman – Nobel Prize winner in Economics in 2002 – and Amos Tversky in 1979. These authors developed their decision making theory in a risk context as an alternative Utility Theory classic, where investors maintain a risk profile regardless of the situation in which they find themselves and their investment decisions are located at the point where the alternatives available in the market coincide with their particular utility function.

Alternative decision-making model

Thus, Kahneman & Tversky (1979) propose a alternative model in which people can change their decision making and even their risk profile depending on the situation in which they find themselves.

Who wouldn't decide to take more risks when they see everything practically lost? Or aren't most of us more conservative when things are going well, in a way trying to protect our current situation? Do we behave the same in the face of different probabilities when we talk about losses and gains?

In theory, if we are rational, Yeah. Kahneman & Tversky developed a model where this is not the case, since our decisions change depending on the probability of the result and whether we are talking about losses or gains. For this two examples:

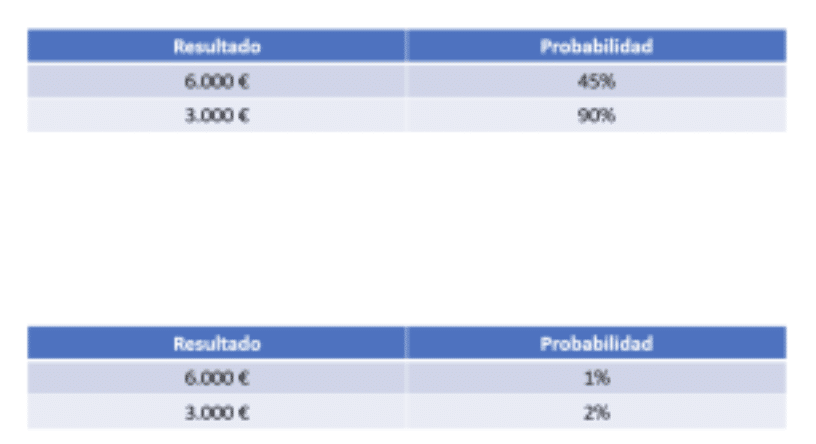

If you had the chance to receive a prize, What would you prefer in each case?

If in both cases you do not choose the €3,000 option, you are not being rational. It seems strange, right? The authors call this certainty effect (Kahneman & Tversky, 1979, pp. 265). Do you think the same thing happens to the managers of a company? Perhaps in strategic direction and decision making the influence of the certainty effect…

reflection effect

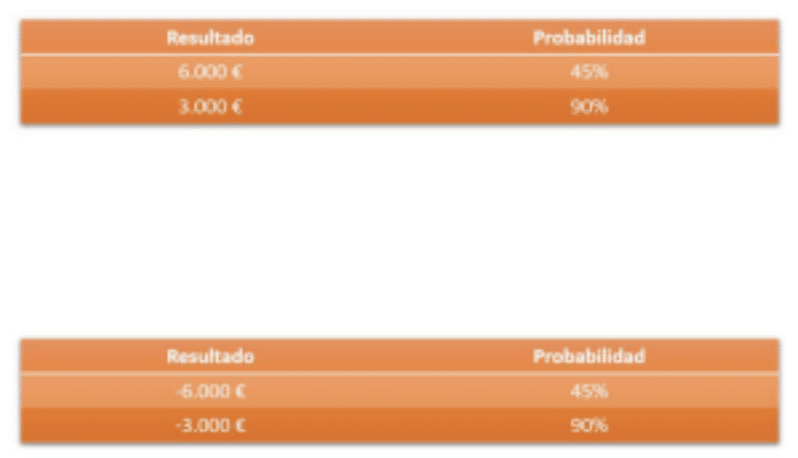

But continuing with the Prospect Theory and the article by Kahneman & Tversky (1979), we are going to deal with the 2nd effect: he reflection effect or reflection effect. This effect implies that the preferences of people—or investors—are reversed when crossing the 0 threshold, which is located on the border between losses and gains. To show a button, changing the signs, but keeping the same figures as the example used in the certainty effect:

As was the case with the certainty effect, if in both cases you do not choose the €3,000 option, your preferences are changing depending on profits and losses.

According to the study, most people will prefer €3,000 with a 90%, but -€6,000 being a more remote possibility of suffering those losses. Realize that the reflection effect It implies that investors go from being risk averse in the case of gains to risk prone in the case of losses. That is, they are not always risk averse as proposed in classic models of behavior and decision making.

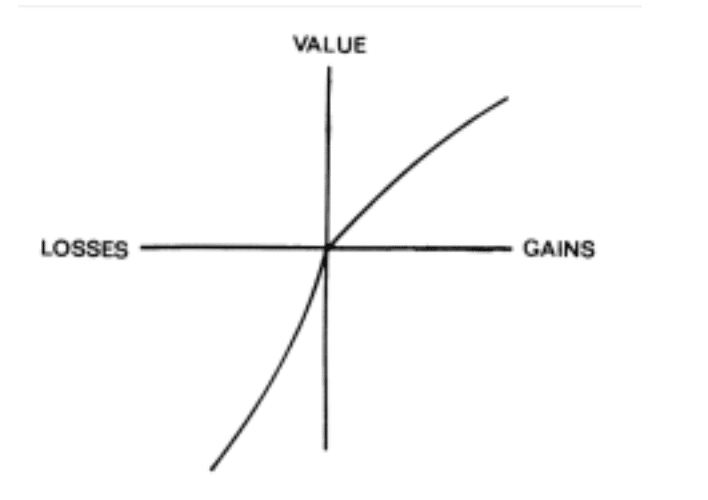

Finally, this aversion to losses is not symmetrical to the pleasure that gains produce: "the frustration (or negative emotions in general) that a person experiences when losing a sum of money seems to be greater than the pleasure associated with winning that same amount" (Kahneman & Tversky, 1979, pp. 279).

Therefore, it can be deduced that also influences the starting point before making decisions, that is to say: reaching €100 starting from €90 does not provide the same utility (positive or negative) as from €110, when according to classical theories on utility in that case it would be equivalent (+/- €10).

In the end, this theory ultimately talks about people, so it is applicable to different fields where people's decisions and their background characteristic (their knowledge, experiences, experience, etc.) play an important role.

Thus, the Prospect Theory It may be unknown, but It is applicable to many situations such as, for example, in the strategic decision making of a manager or the selection of financial assets and markets in an investor. Furthermore, apart from adjusting to reality more adequately than classical theories of decision or utility, Prospect Theory It has been corroborated in practice by other studies and is still valid today.

David Cabreros González, student of Master in Financial Management, Accounting and Management Control has been in charge of this post and of explaining the importance of decision making within finances. With this Master you will be trained to lead the comprehensive financial-fiscal management of the companies.

REFERENCES

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrics, 47(2), 263–292. https://doi.org/10.2307/1914185