The prevention of the defaults It is a key factor for the survival of many companies, Since the crisis It has reduced the results and balance sheets of many of these, leading some to bankruptcy and others to the brink. The commercial credits are today the subject of a exhaustive analysis in the societies hence the import of accounting management of uncollected commercial credits.

In this article we review and clarify what the accounting management of non-payment situations is and how we can account for bad debt losses.

Objectives of this article

- Know the accounting management of non-payment situations and the accounting for the deterioration in value that it causes.

- Account for the reversals of commercial impairments caused by non-payment situations and account for the uncollectible loss, as well as the collection in the event that it becomes effective.

The main aim of every company is to obtain a benefit and ensure the permanence of your activity over time. To this end, relationships with its clients and debtors are part of the backbone to achieve this objective.

Inside of usual activity of a company you can find, on the one hand, the income or sales of its products or services and, on the other hand, the charges generated by the sales made. These collections from clients and debtors may never occur, or may have clear indications of being uncollected.

In accounting, these "assets" of doubtful collection or uncollectible are called “losses due to impairment of commercial credits”.

The "rule" that establishes the way to proceed with “doubtful or uncollectible assets” is found within the General Accounting Plan, specifically in the “NRV 9ª 2.1.3 of the PGC-PYMES”, which tells us the following:

- At least at year end, must be carried out valuation corrections necessary, as long as there is objective evidence that the value of a financial asset or a group of financial assets with similar risk characteristics assessed collectively, has deteriorated as a result of one or more events that have occurred after its initial recognition and that cause a reduction or delay in the estimated future cash flows, which may be motivated by the insolvency of the debtor.

- The valuation corrections due to impairment, as well as reversal when the amount of said loss decreases due to a cause related to a subsequent event, will be recognized as a expense or income, respectively, in the account of Profit and loss.

With the information provided by the General accounting plan, we can differentiate three cases, for the treatment of deterioration in commercial operations:

- Loss provision: before the appearance of a non-payment of an invoice and evidence firm of non-compliance with payment by a client, a subaccount will be created as questionable client charge and will be provided loss of commercial credits.

- Reversal of endowment: if a customer classified as dubious collection pays the debt incurred, will revert the allocation operation carried out in their accounts.

- Certification of loss: In the event that the loss of credit commercial, it will be counted as bad the amount managed as doubtful collection.

ALLOCATION TO THE PROVISION FOR INSOLVENCY OF COMMERCIAL CREDITS

If after 6 months from the date of issue of an invoice, the debt is not collected, the client will be declared as “Doubtful customer” and “will load” for the total amount of credits classified as uncollectible. To do this you must create a new subaccount “Doubtful customer”, subaccount 436, for each client. The resulting seat is “will pay” against the subaccount of customers correspondent.

- During the creation of this first entry, it would not yet be confirmed if the client is going to pay the pending credits or if these should be managed as a irreversible loss.

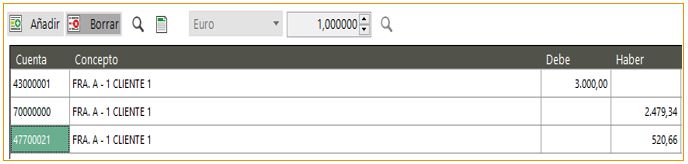

To view the entries resulting from the transactions "endowment", We will work on the examples under the assumption of the issuance dated 01/31/202X of an invoice for a value of €3,000. Below is the sales seat:

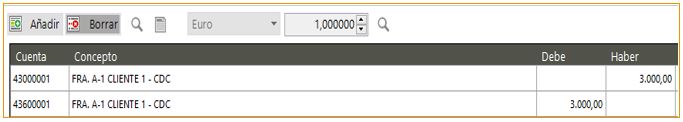

Past 6 months From the date of issuance of the invoice, or at the moment in which you have indications of the risk of insolvency on the part of a client, the following entry will be made for its reclassification as “Doubtful customer”, as you can see in the following image:

- With this seat it has been achieved pay off the debt of the client within his subaccount, through the "pass" of the amount owed, and the debt for the same value within a doubtful customer subaccount, thus achieving separation these doubtful credits from the usual customer credits.

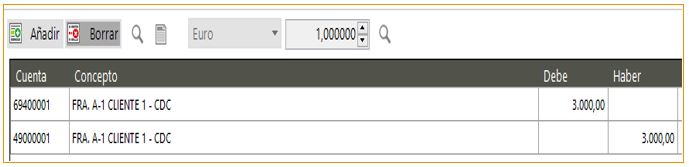

Once the client is reclassified, the next step will be endowment of the provision. To make the seat you must "carry" the amount at risk of being unpaid in subaccount 694 “Losses due to impairment of commercial credits”, with "pass" to subaccount 490 “Impairment of value of commercial credits”. The resulting entry would be:

The purpose of this entry is to record as a loss the amount of a sale, which is not expected to be collected. So in the "Profit and loss account", the amount of the income, which was generated at the time of the sale, will be settled with the new entry of the endowment.

REVERSAL OF THE ALLOCATION DUE TO INSOLVENCY

If after the classification of a customer as a doubtful collection and the provision of unpaid credit, the client attend to the debt that you contracted with the issuance of the invoice, you must reclassify and settle the operations carried out by the endowment.

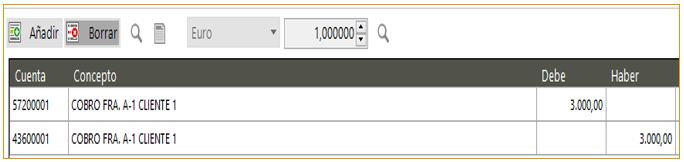

Once received the amount in the bank of the debt incurred, "burden" the same in the subaccount of the bank where you have received the payment, subaccount 572, with "pass" to subaccount 436 created for the doubtful customer, thus settling the subaccount in case of receiving the pay total or partial, reducing the amount owed.

The following entry will be made for the collection of the invoice:

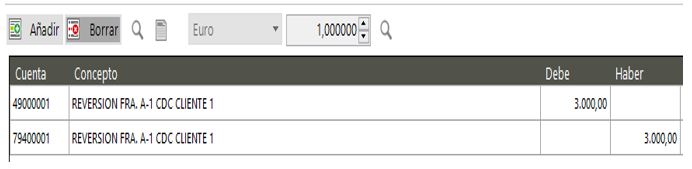

To carry out the reversion of the endowment generated by classifying the client as doubtful collection, will be noted in the "has to" the amount received within subaccount 490 of “Impairment of credits from commercial operations”.

This seat must be square up against a subaccount income 794 “Reversal of the impairment of credits from commercial operations” that will be paid to cancel the endowment for provision that has been previously registered.

Below we show the resulting seat:

These two seats reversion of the provision and endowment will be accounted for with the date in which they have been received doubtful commercial loans.

CERTIFICATION OF LOSSES

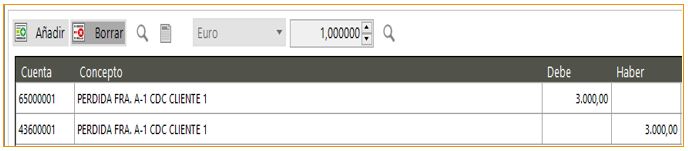

If we have the certainty, that a doubtful credit will result bad, you will classify the debt as a "irreversible loss" posting the amount in an expense account, specifically in subaccount 650 “Losses on bad trade credits”.

In a first seat, will load the amount of the loss in subaccount 650. With pass to the subaccount of customer of dubious collection 436:

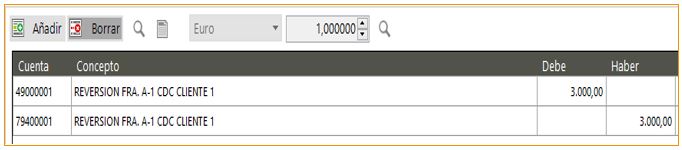

In a second accounting entry, will revert the entry made by the classification of the client's debt as a credit dubious collection that you made against subaccount 490, since this has gone from being of doubtful collection to being a definitive loss. In this seat you must carry, the amount of valuation corrections for impairment of bad debts made, with pass to subaccount 794. “Reversal of the impairment of credits for commercial operations.”

The resulting entry is shown below:

If we carefully examine the movements made, we can see how the endowment that was created with the appearance of the uncertainty of payment and how, when it became real, the definitive loss, settling the client's subaccounts dubious collection (436) and the subaccount of the impairment (490).

They will be declared, as not tax deductible, those credits that were bonded, guaranteed, by public or private law entities. Likewise, those credits for which the creditor has waived a part of it, in order to collect the rest, will not be deductible, considering it a friendly agreement.

Don't miss all the financial news from the best professionals in the sector in our Master in Financial Management, Accounting and Management Control.